B2B SaaS App, 4 months

Reports and insights for print environments

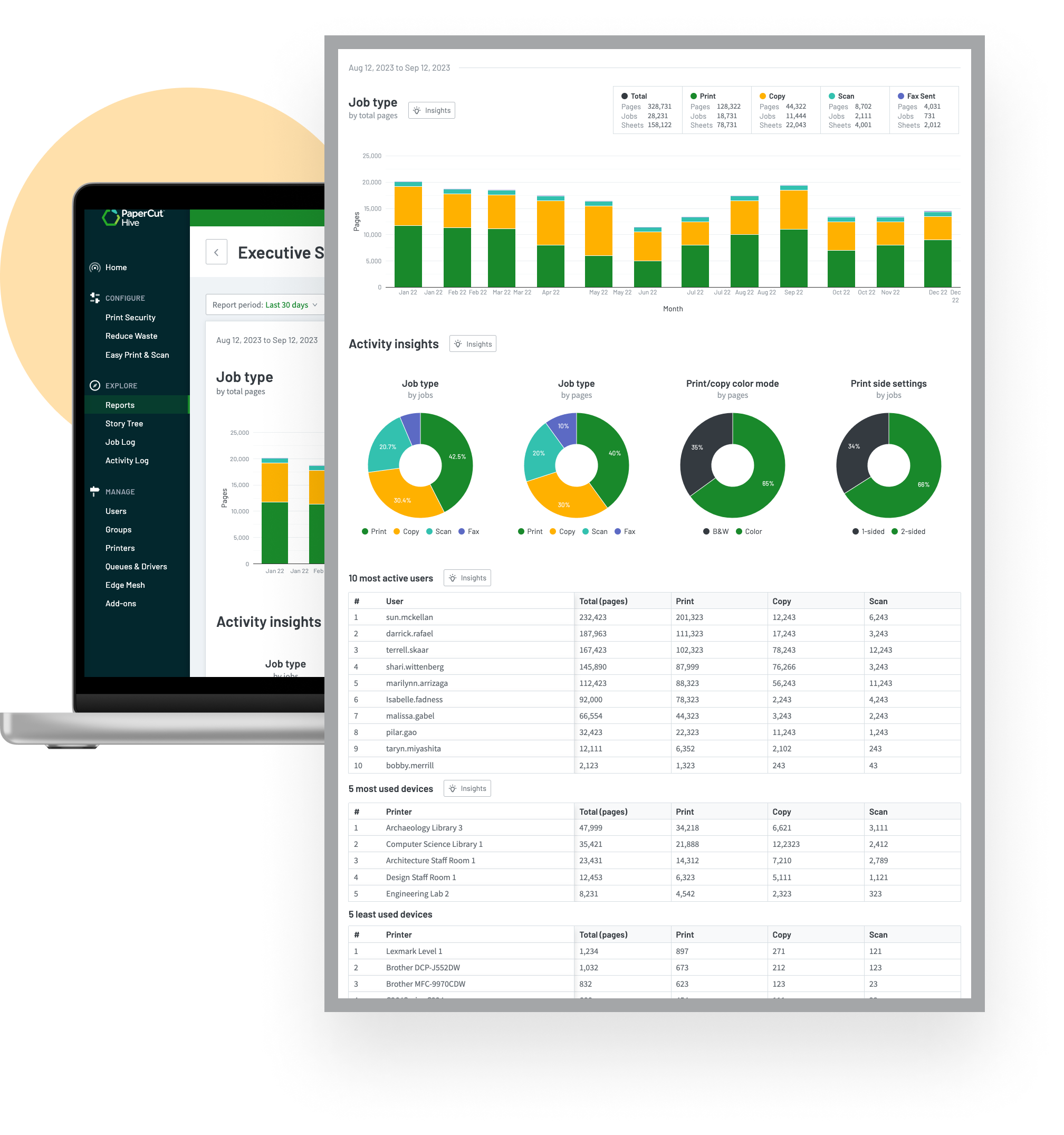

Reports in a print management application provide valuable assistance and confirmation of value to the business by providing comparative insights into cost, waste reduction, and security issues. As the initiative’s design lead, I provided end-to-end help in developing a high-quality reporting and insights tool for consumers.

My role

- Discovery: 4 weeks

- Ideation & design: 6 weeks

- Prototyping: 3 weeks

- User testing: 3 weeks

- HTML prototype refinement 2 weeks

Team

- Design Lead (myself), Product lead (Keith), Dev lead (Shalini), Front-end dev (Mat W), and 6 Devs

- Tools: Miro, Figma, Draw.io, Google Charts

Business goals

Increase conversion rate of customers evaluating the product by 10%.

Product goals

Provides admins with statistics and actionable advice on waste reduction, cost, and security improvements.

The problem statement

Our product can track every aspect of print activity, yet the provided information is fragmented. As a result, org admins fail to spot opportunities to reduce waste and improve resource utilisation.

How will we measure success?

Discovery: At least one report generated within the first 30 days after signup.

Frequency: At least 2 reports generated within 90 days.

Final outcome

The app before reports

In the absence of reports, the admin struggled to convert available data (available as CSV) into meaningful insights, not they had ability to identify usage anomalies (e.g. print abuse) or trend-lines which or usage forecasting.

Why do reports matter?

For business

- Its a table stake, our competitors offer that

- To provide an evidence of value prop we offer

- Confirm ROI to decision makers

- Influence customers to continue to subscribe

For customers

- Investigate: What jobs are customers trying to do using reports

- Investigate: Context of use

- Investigate: Frequency

- Investigate: Secondary jobs related to it

Project inception

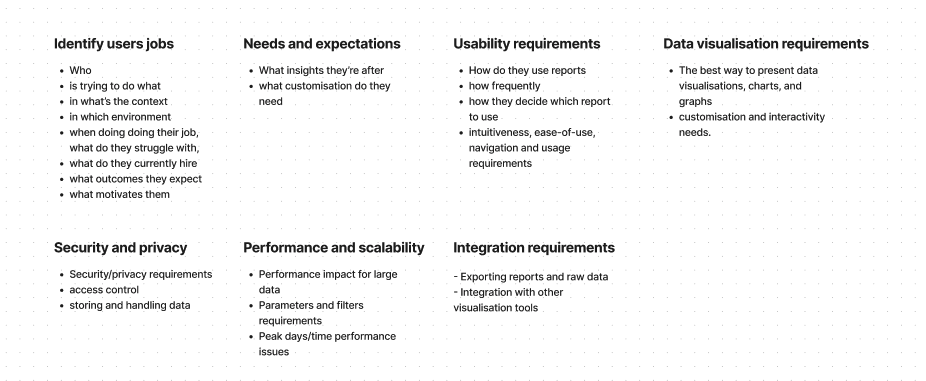

The inception phase marked the formal launch of the initiative, where product owners, directors, and the product trio (PM, UX Lead, and Dev Lead) collaborated to define our goals and key areas of investigation.

Discovery

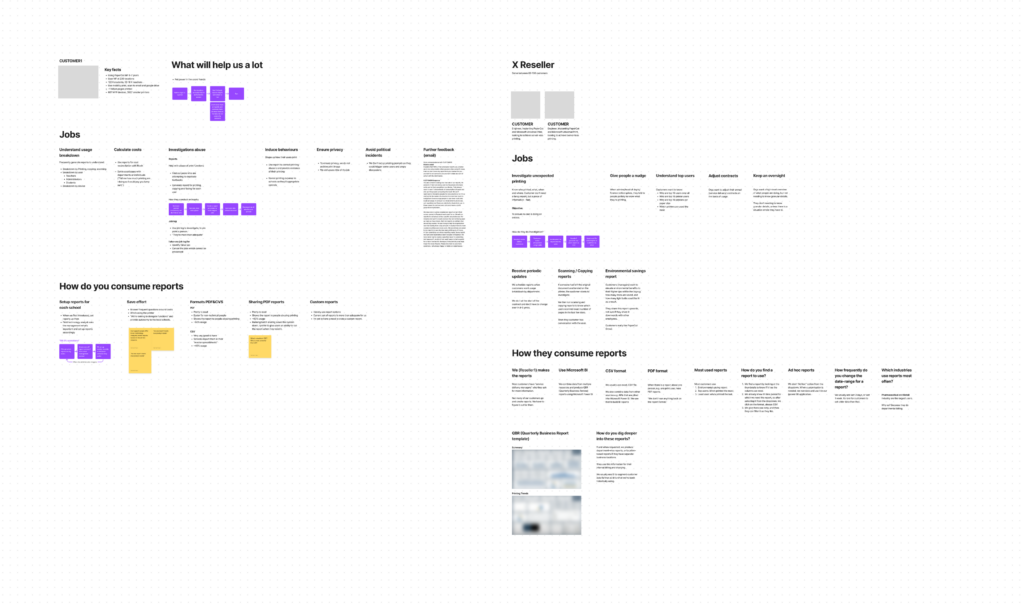

Customers and partner interviews

4 weeks long discovery session included interviewing: 4 partners/resellers and 7 customers scattered across Australia, Europe and Americans with a view to understand jobs, context, needs, wants, and desired outcomes.

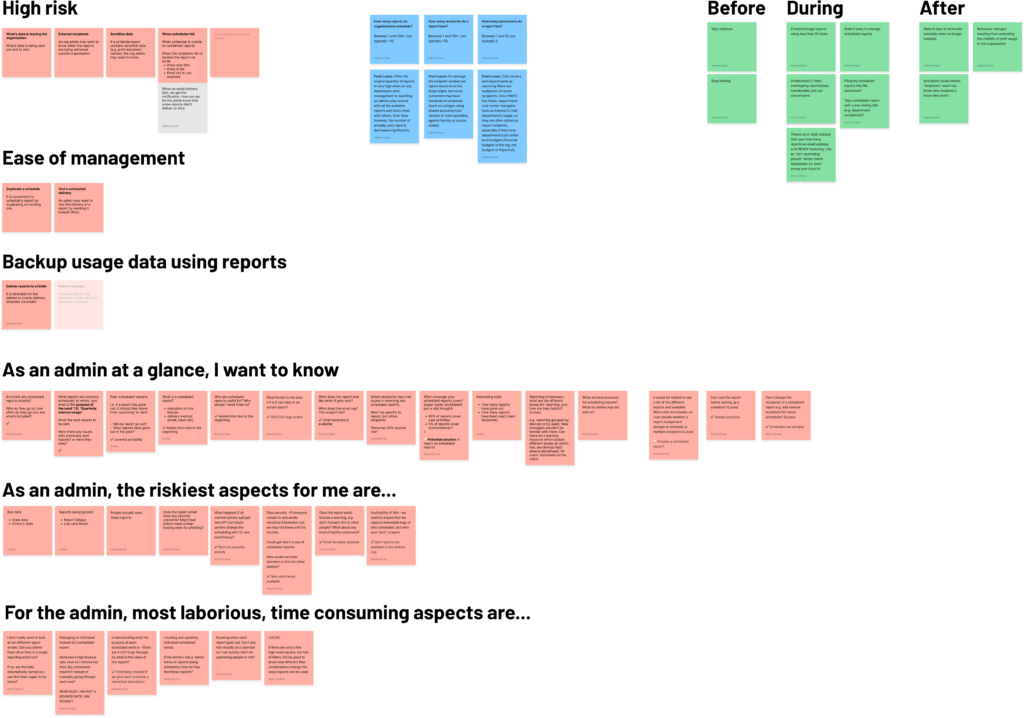

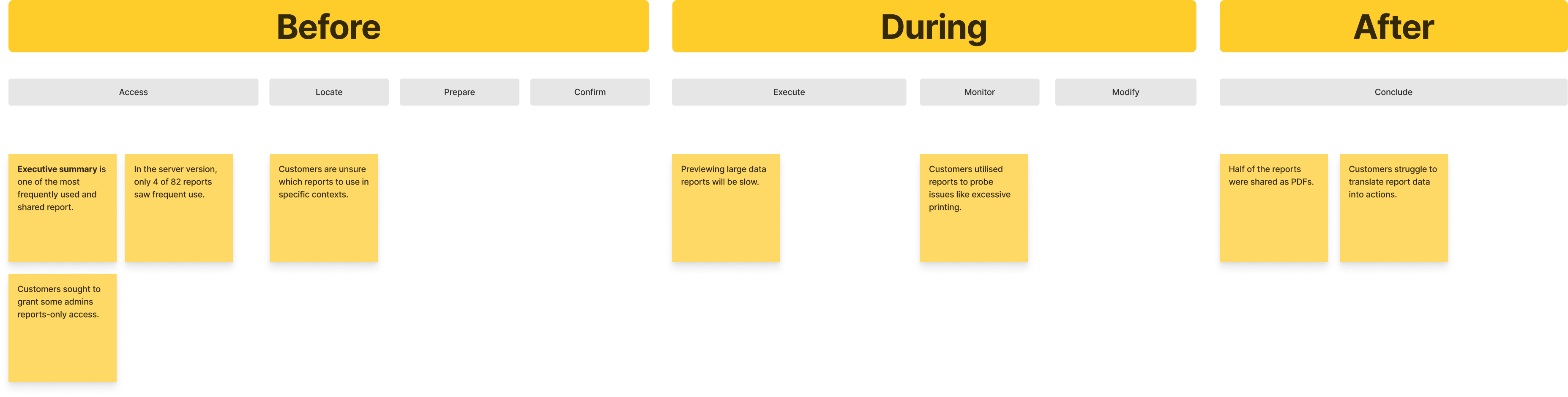

Synthesis of user feedback

I analysed user insights from multiple angles to pinpoint risky, error-prone, and time-consuming processes.

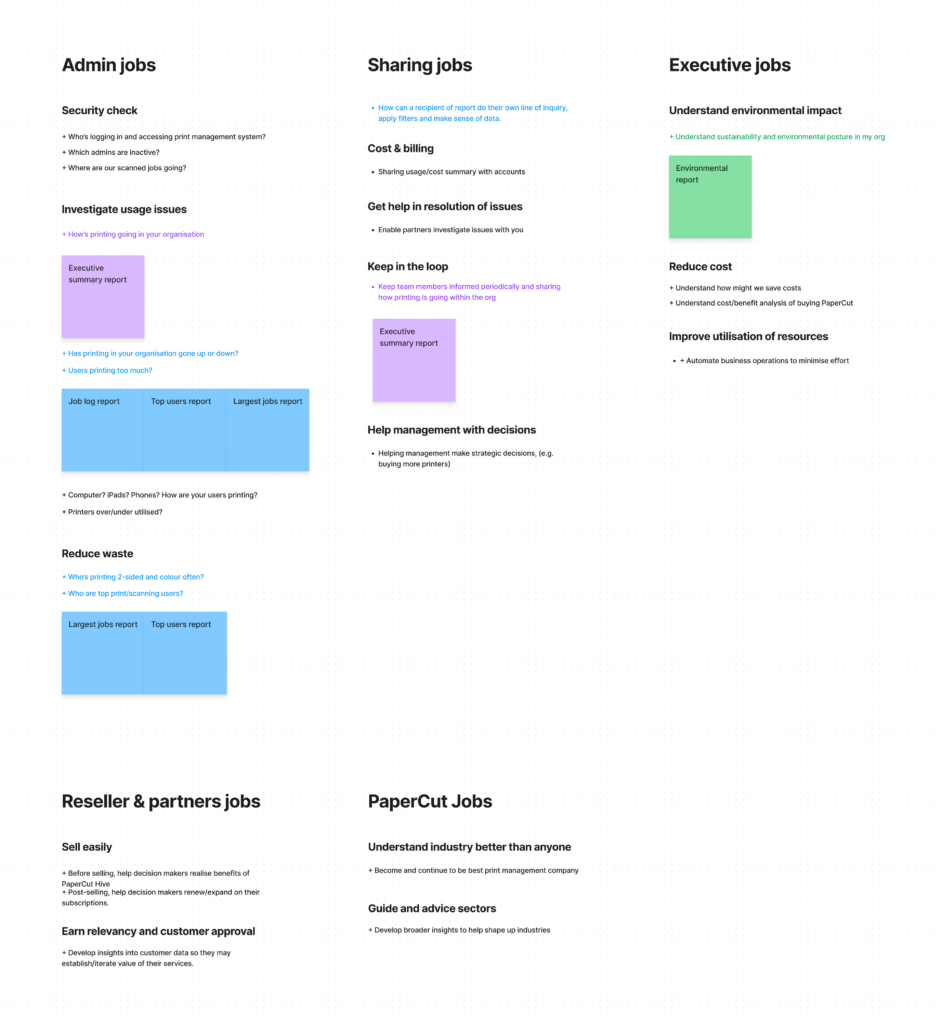

Key Jobs users are trying to do

Key learnings from the users

Admins

- Admins lack knowledge and expertise to interpret reports data into actionable steps.

- Admins struggle to find opportunities to reduce waste or save cost.

Executives

- Executives are interested in statistics confirming ROI.

- Timely access to insight is key.

Resellers

- Resellers offering trials struggle to generate statistical evidence of ROI and benefits.

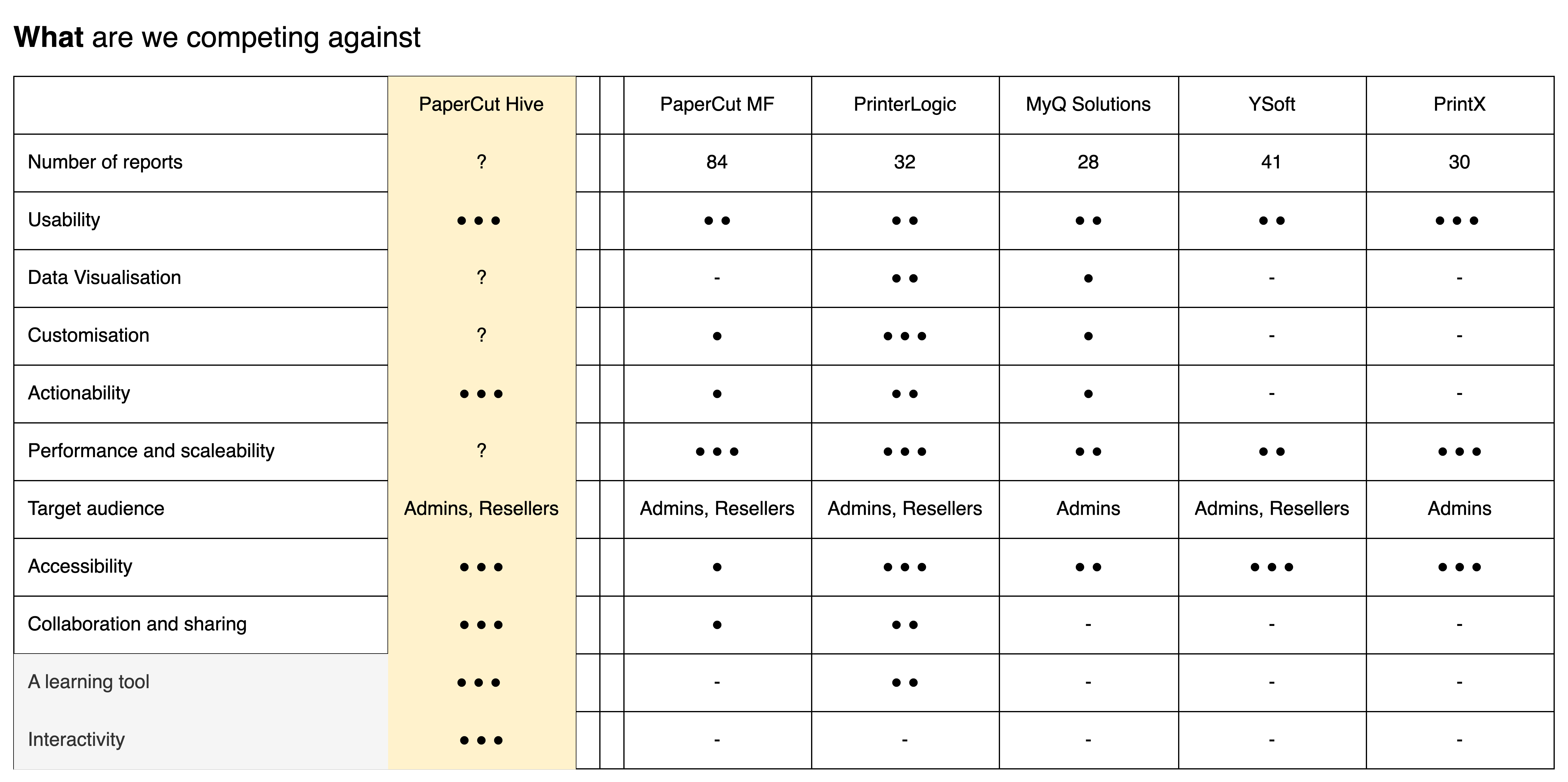

Learning from competitors

A deep dive into four key competitors revealed their strengths and weaknesses in providing insightful reports and visualising the big picture.

This analysis had a direct impact on both our design decisions and marketing strategy. We leveraged this knowledge to ensure our reporting solution delivers superior value and stands out in the market.

Key learnings from competitors

- Customisation and actionability of report is uncommon

- We’re behind in performance and scaleability

- Interactive reports can be a value differential

Learnings from the non-competitors

To gain inspiration, I broadened my research beyond the print management space, studying leaders in data visualisation and analytics like Google Looker Studio, Metabase, and Binance. This approach fuels innovation, expands our perspective, and encourages us to learn from industry leaders, driving us to surpass competitive offerings.

Key learnings from non-competitors

- Looker studio offers one of the best interactive reports

- Maximise availability of screen realestate

- Bubble up frequently used reports to the top of the list

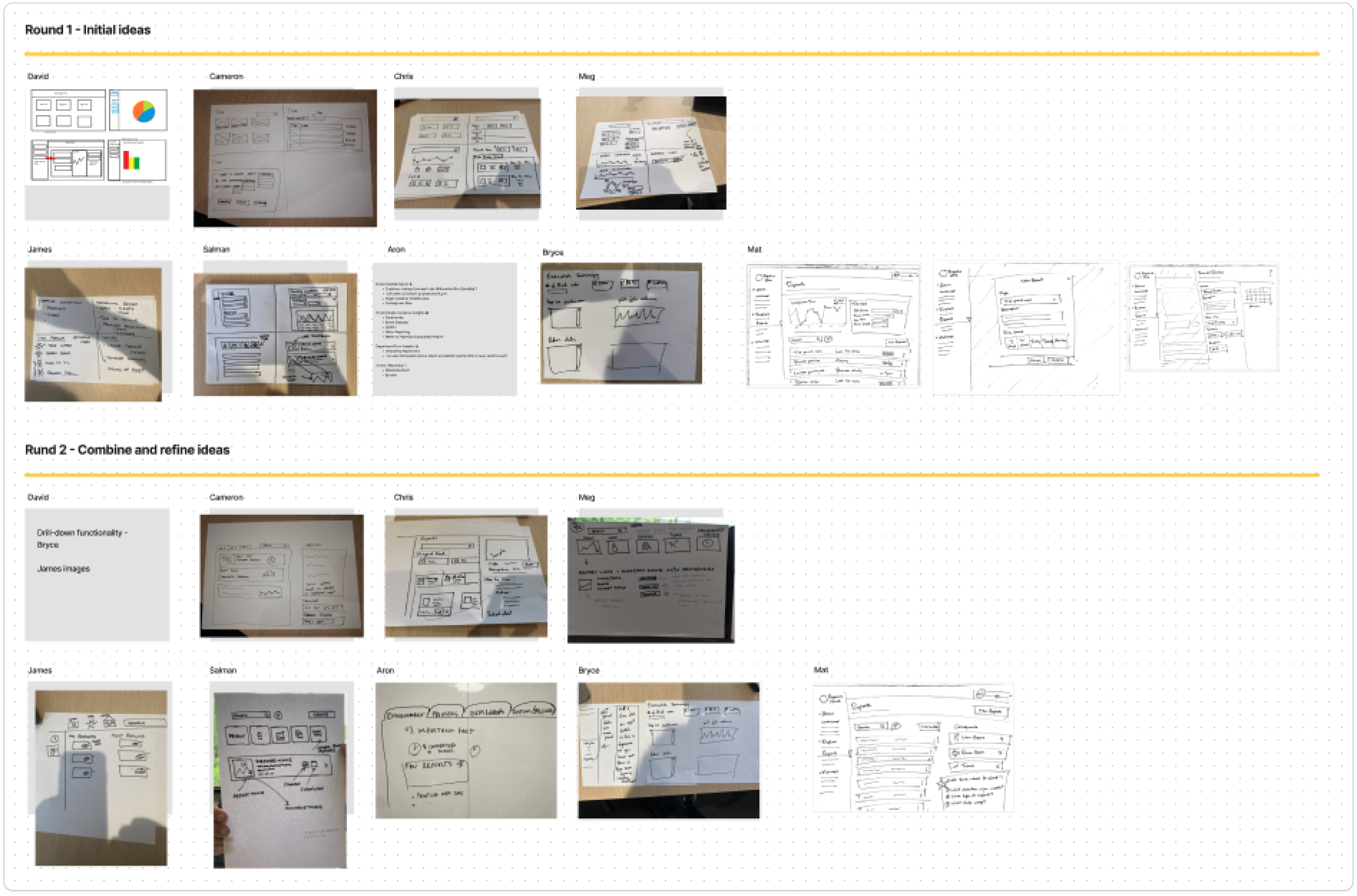

Ideation

How might we help admins identify waste reduction and cost saving opportunities, giving them actionable insights and advice they could apply?

I conducted at 4up/6up ideation session with the team inviting members from technical support, marketing and PMs from server-based products to brainstorm thoughts how might we provide a solution to key problem areas identified in the discovery phase.

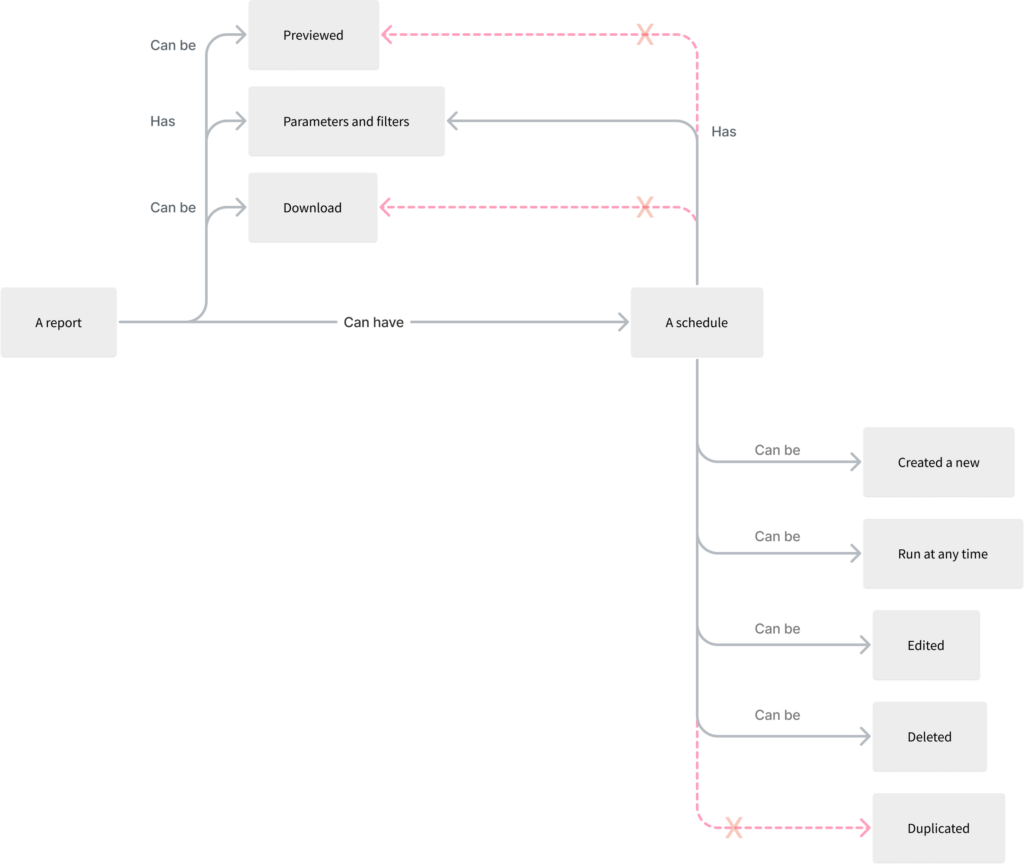

Functionality mapping

Functionality mapping is a powerful tool for understanding the relationships between different entities within a complex system, particularly those involving shared operations and processes. By visualising these connections, we can identify potential bottlenecks, redundancies, and opportunities for optimisation.

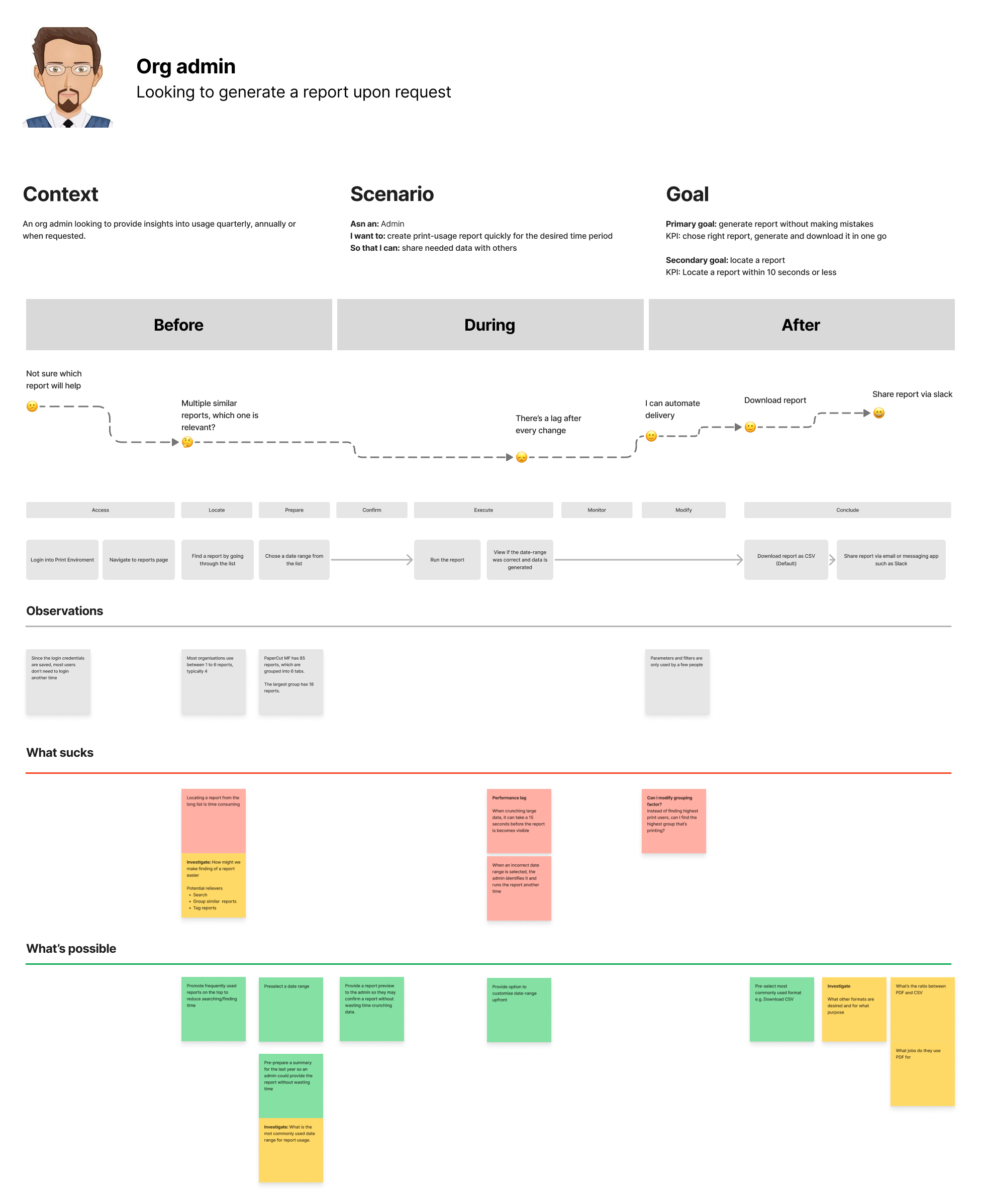

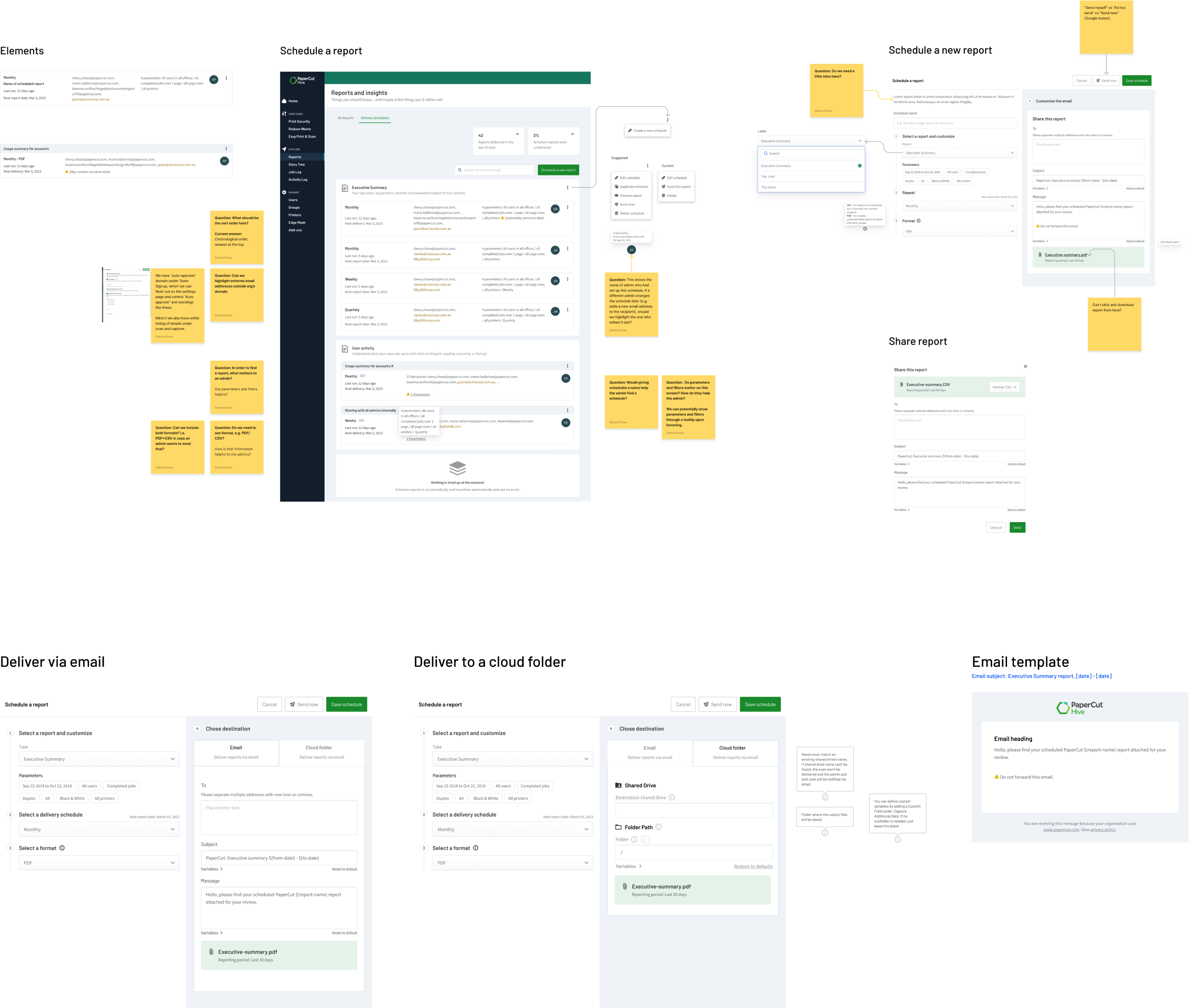

Converting ideas into possibilities

I crafted several detailed low-fidelity user flows to devise an approach that enables users to locate and create a report within three clicks or fewer. Here are some of the flow variations I produced using Figma.

Evaluation with stakeholders

At this stage, the solution is starting to take shape and I seek extensive input from the Trio, product owner, SME and marketing lead to ensure:

Technical Validation: Ensuring proposed solution is feasible, scalable, and aligns with the product architecture.

Usability Confirmation: Verifying that the user flows are intuitive, address core pain points, and meet user expectations.

Business Alignment: Confirming that the solution supports key business goals, KPIs, and the overall product vision.

Messaging and Positioning: Crafting a compelling narrative about the solution’s value, ensuring consistency with marketing strategy.

Design

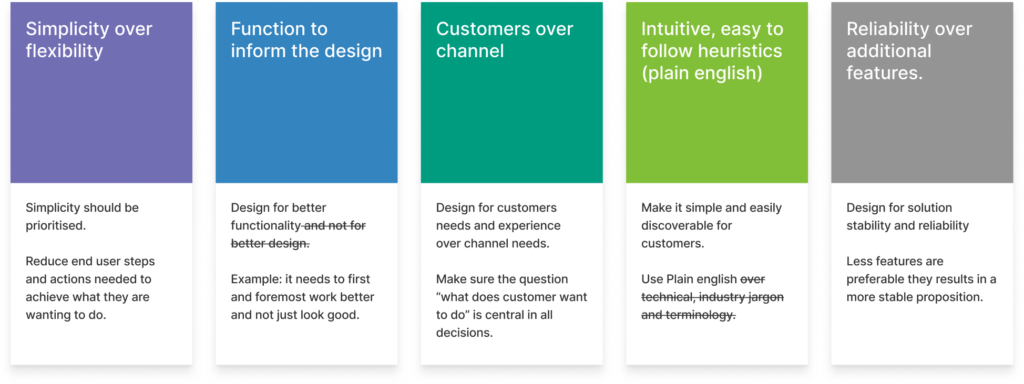

Design principles

Design principles function as a strategic compass, ensuring design decisions align with user needs, business goals, and the product’s overall vision. Rooted in a deep understanding of customer jobs, contexts, desired outcomes, and competitive offerings, these principles provide a clear framework for evaluating design choices.

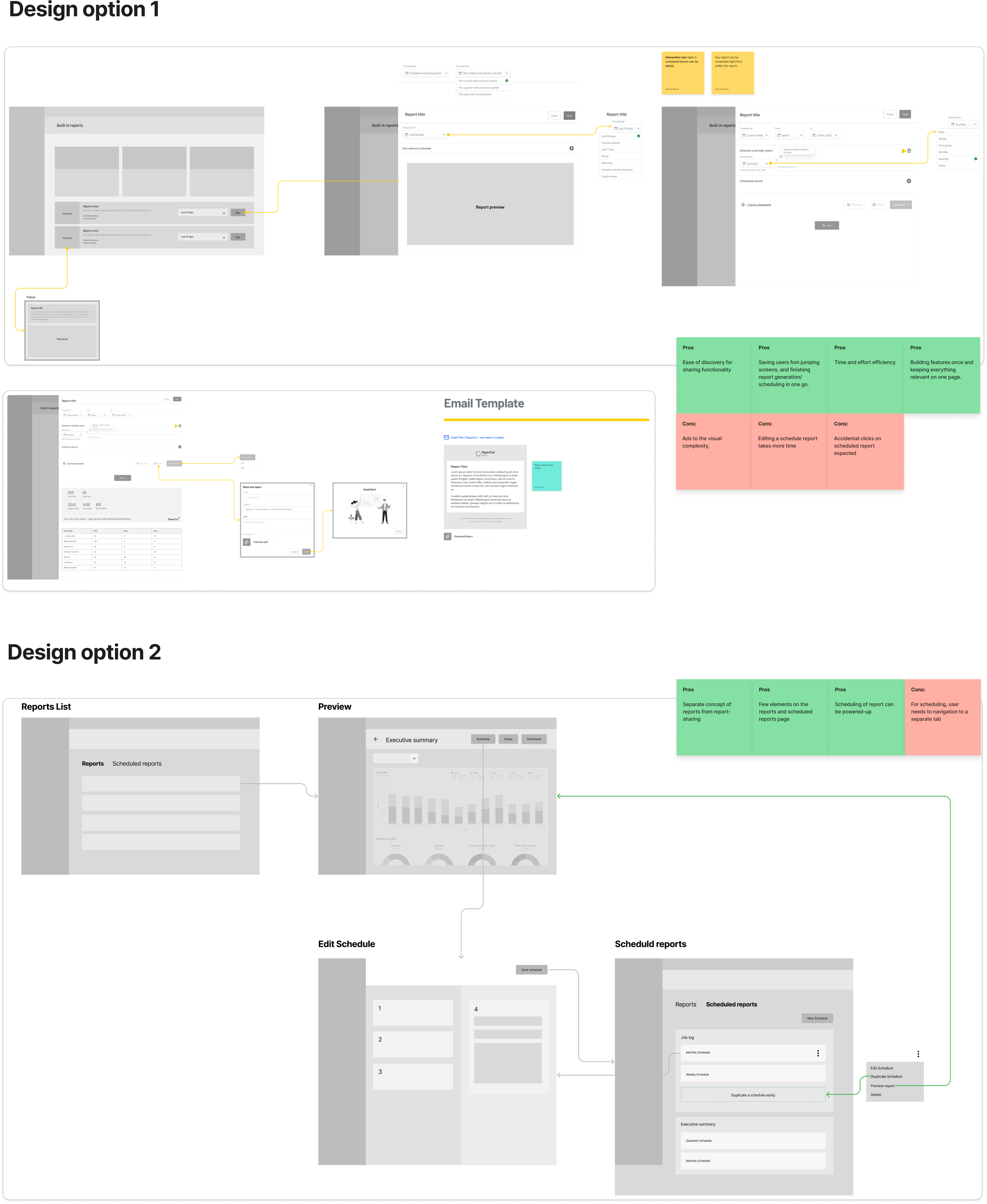

Mid and high fidelity design

After careful consideration, I choose a design solution to undergo further refinement. When uncertainty or divided opinions arise, I mature multiple design solutions and conduct A/B testing for informed decision-making.

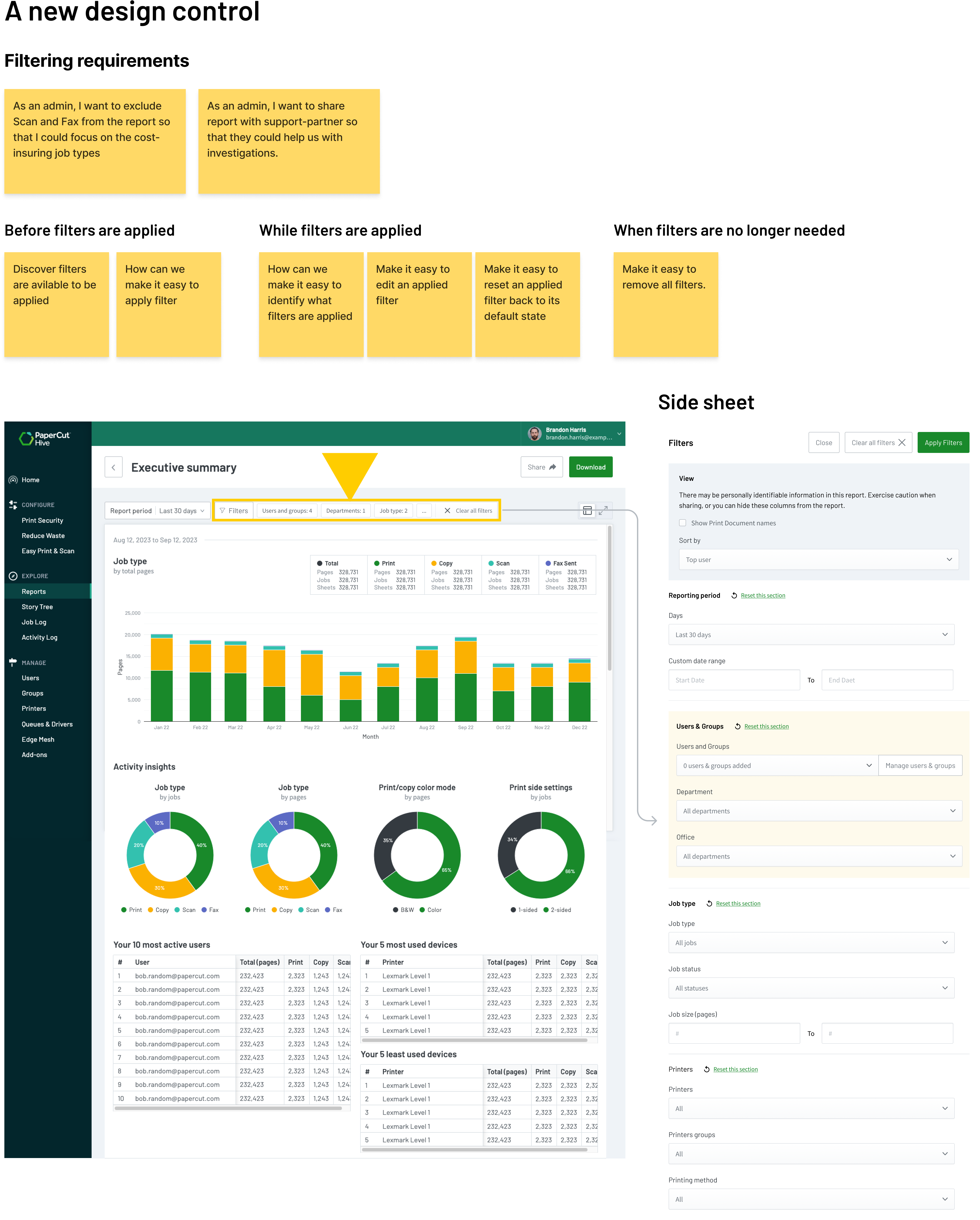

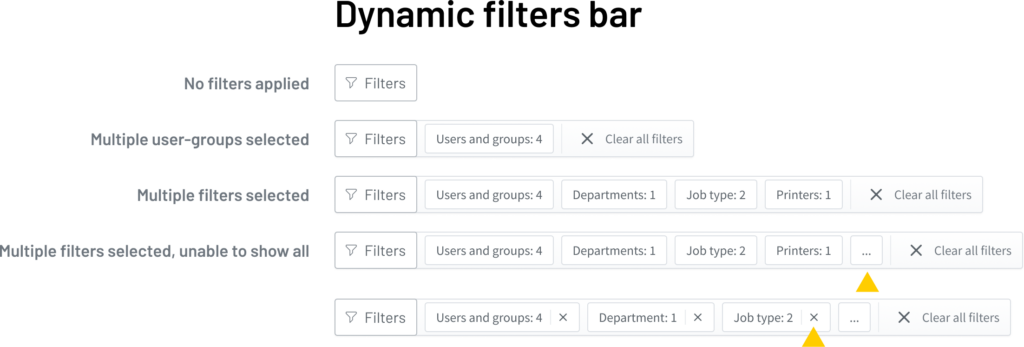

Designing an new control for DLS

The complex filter and parameter system posed a significant design challenge, offering admins extensive control over report data. To address this, I led a collaborative workshop with SMEs and fellow designers. Together, we analysed filter usage scenarios and established a scalable design pattern capable of accommodating future filter additions. Below is a key outcome of this workshop.

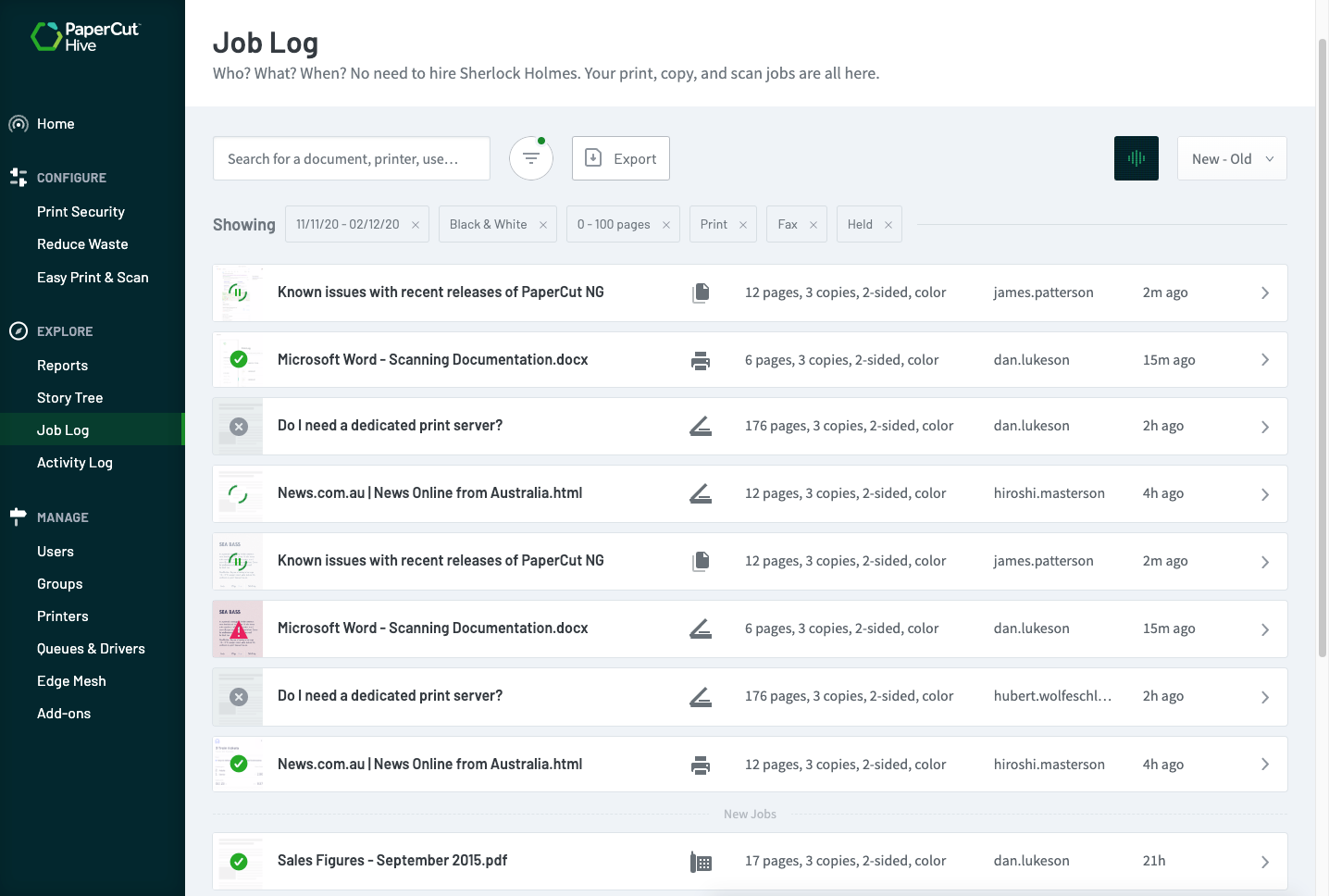

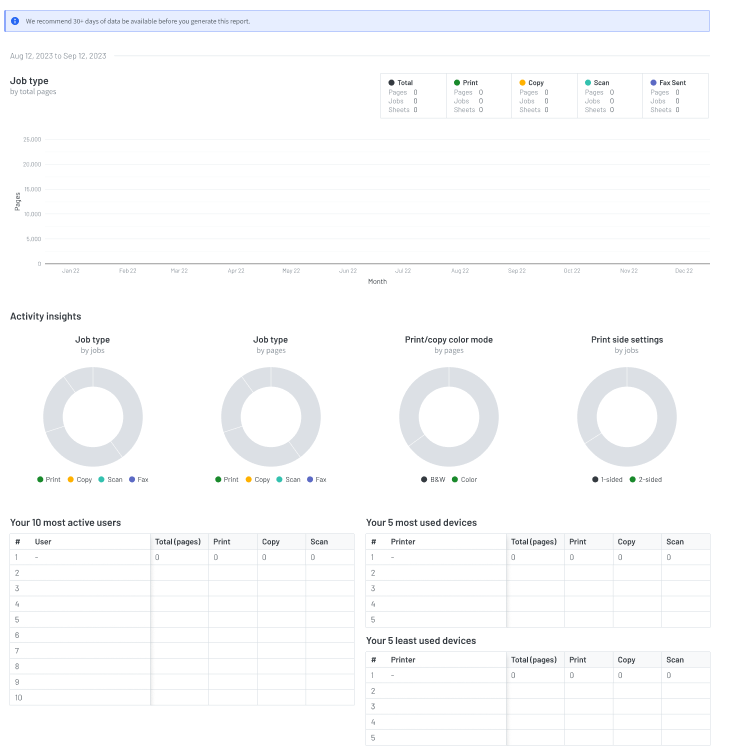

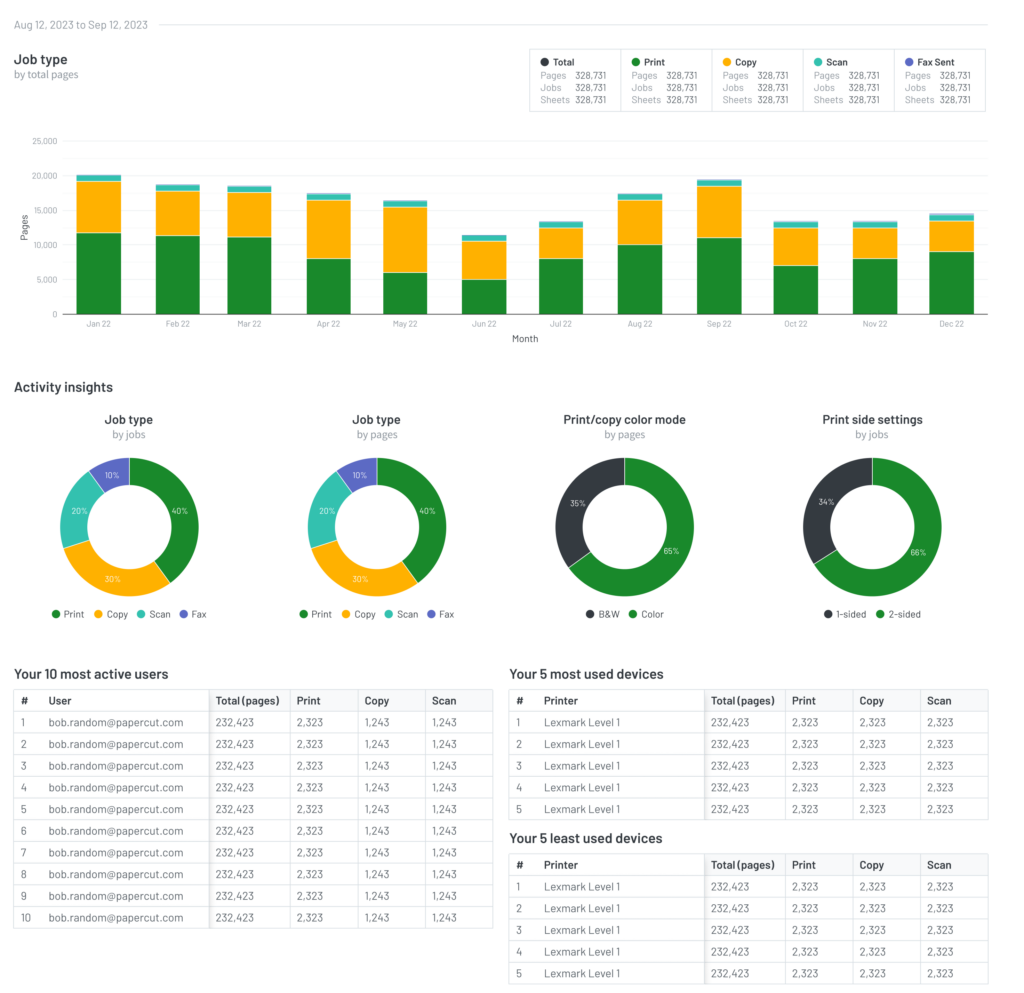

Individual reports design

Each report design went through a rigorous micro discovery, ideation, and design process to ensure that the defined tasks were completed properly and that consumers got just the essential data in an engaging and actionable format. Below is a breakdown of the steps I used to establish the content of each report.

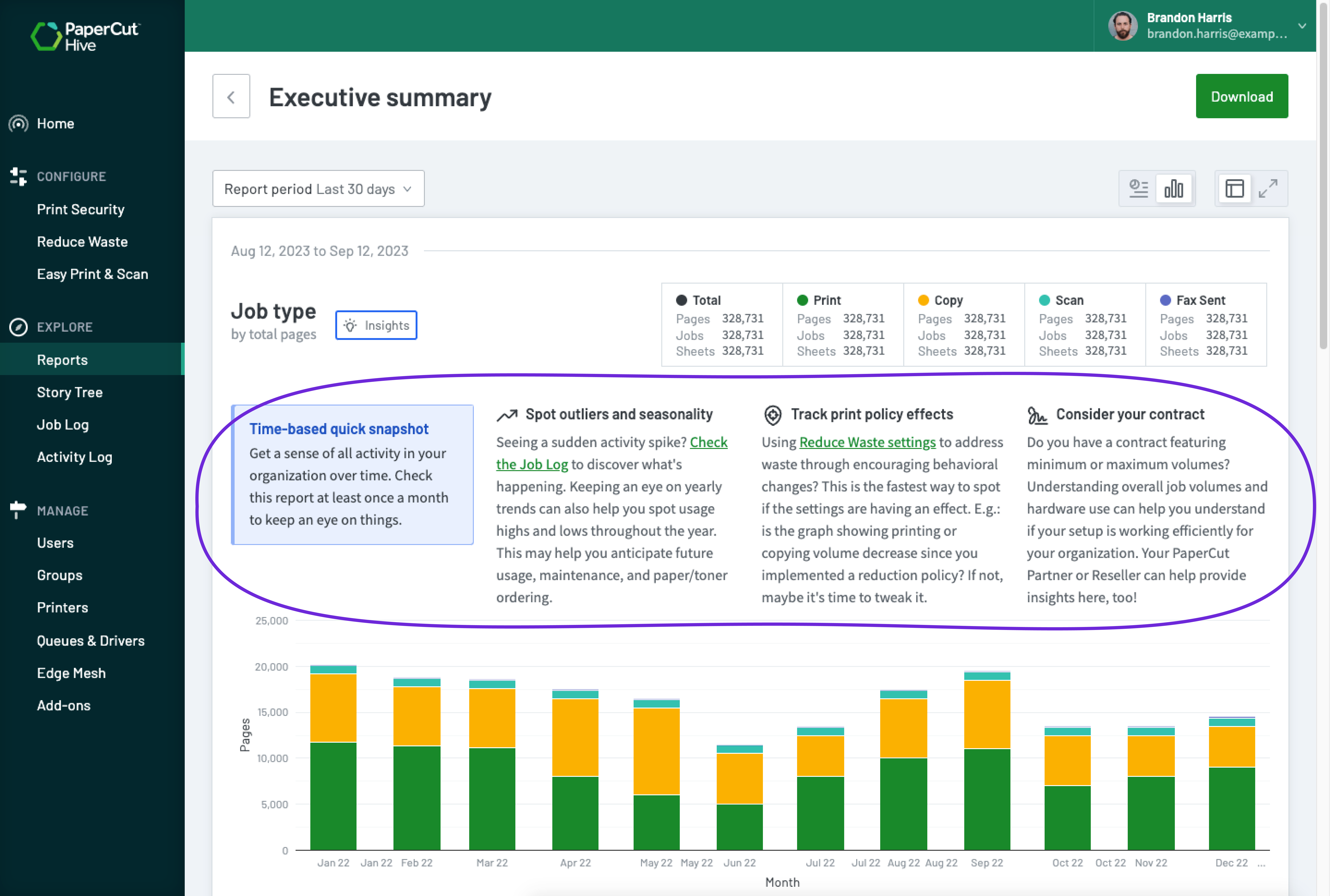

User problem: Admins lack knowledge and expertise to interpret reports data into actionable steps.

Solution: Make reports comprehensible for the new and untrained admins

A key aspect of enhancing the user experience was the report’s ability to guide admins and empower them to act on the insights. To achieve this, I collaborated closely with an SME and content writer to create clear explanations for each report section. These explanations offered admins actionable guidance on how to leverage the data to reduce waste, enhance security, and improve ease of access within their organisation.

User testing on Figma prototypes

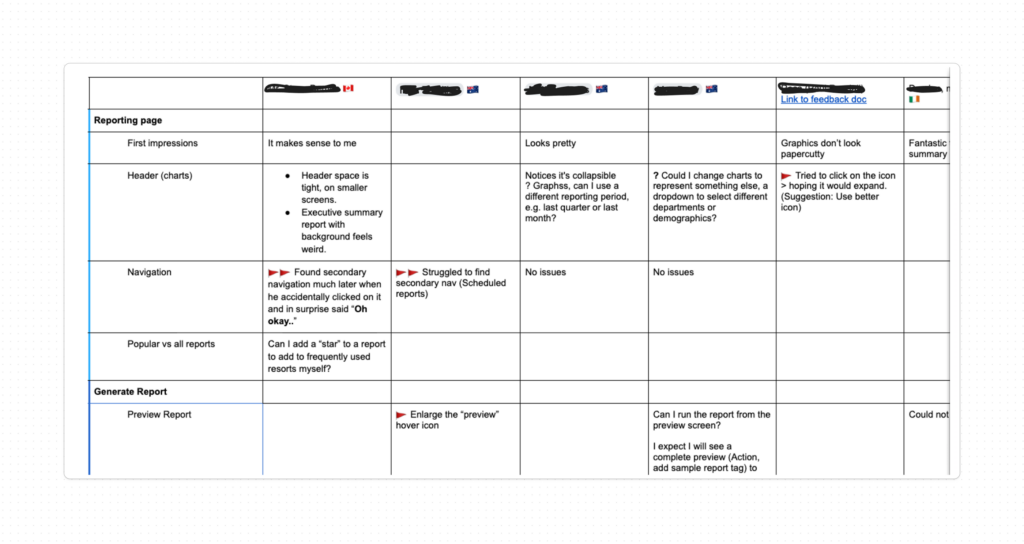

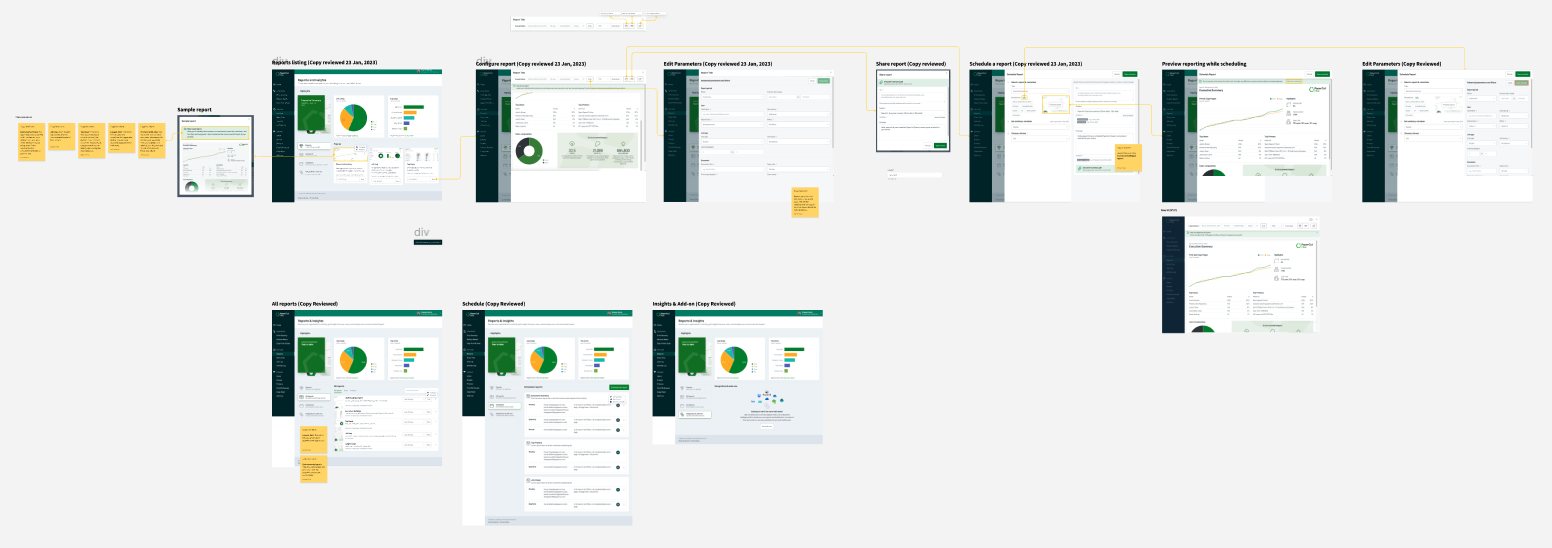

I created a clickable Figma prototype from the high-fidelity design, ensuring it was meticulously prepared for testing. After an initial copy review, the design was presented to resellers and customers for feedback.

Improving design as per user feedback

User testing highlighted several improvement areas requiring attention. I implemented a ‘3 flags’ reporting system to pinpoint minor issues and confusing designs needing resolution before moving forward.

What is working

- Reports as a learning tool: To assist admins, each report preview included a summary explaining its use, becoming a valuable resource for new admins to select appropriate reports for different contexts.

- Ready-to-download reports: The summary report, highly used in the server-based platform, was well-received as a pre-generated, one-click download.

- Efficient reports generation: Users valued the pre-selected reporting periods, enabling accurate reports from the start. With just two clicks, users could select, generate, and download reports, an efficiency that garnered appreciation.

What needs to be better

- Below the fold navigation: Initial tests revealed usability issues with navigation elements placed below the fold, causing user difficulty in finding them.

- Download as PDF: Users consistently requested report downloads in PDF format, favoured for record-keeping and interdepartmental sharing, prompting its prioritisation in the next release.

- Share report via email: Noting a preference for sharing over downloading, we introduced an email sharing feature in the first release and planned future scheduling capabilities, ensuring each update meets user needs and improves experience.

User feedback on the 1st design iteration

Initial feedback from four resellers and internal SMEs was highly positive. The reports provided administrators with valuable insights, learnings, and a greater sense of control. Based on this feedback, we identified and addressed specific communication issues and visual weaknesses, significantly enhancing the reports’ clarity and usability.

User feedback on the 2nd design iteration

Our initial design mixed scheduled reports with the primary report list, hindering usability. Users could reschedule reports multiple times with varying parameters, creating complexity and visual clutter. This made distinguishing core report functions from scheduling details difficult. In the next iteration, I separated these sections, providing a clearer and more focused experience.

User feedback on the 3rd design iteration

Nature of third review was mostly around messaging and including message that set the user expectations around what’s coming ahead, e.g. a more powerful analysis tool and ability to share reports using a URL. with he final review in place, the team was ready to convert Figma designs into HTML prototype.

Development

After prototype testing and achieving initial product-design benchmarks, I support the developers to convert the design into HTML prototype which will become a reference and source of truth for design assets and copy.

As the product was being built, I participated in beta-testing to ensure production is as closely aligned with the design as intended and there’s no “design-leakage” in the process.

Behaviour tracking

The true assessment of a product unfolds when a group of users engages with it in an unmoderated setting. Leveraging usage Google Analytics I tracked how users were engaged with the application and areas may require further improvement.

Outcomes and success

While reports are a standard feature in print management apps, they can play a crucial role in establishing and confirming the ROI and environmental value that customers seek. The reports initiative was rolled out over several releases, starting with four basic reports and essential report generation and viewing capabilities, which were well-received. Here are some key successes of the initial offering.

Feature discovery

62% of customers interacting with it within the first 30 days validating its access and ease of use.

High user engagement

On average, customers download 2.4 reports, against a target of 2 reports each quarter.

Request for new reports

Another sign of user engagement is the growing demand for additional reports, indicating users have received benefit and are eager for more.

Thank you for going through this case study. If you would like to learn more or have a similar initiative, reach out at SalmanEhsan@gmail.com or through my LinkedIn page.